Land Purchasing: Lessons Learned

- Use Multiple Apps for Search: Use multiple real estate apps in your search. I’ve actually found that Trulia seems to have the most land lots posted. Size and location matters, really large lots might considered commercial land and aren’t on typical real estate apps. I recommend also looking at LoopNet.

- Take a Drive: Drive around the area you want to live and look for “For Sale” Signs. We found multiple lots that weren’t on any real-estate apps. My only guess is the seller didn’t want to pay realtor fees, and isn’t in a hurry to sell.

- Check the location accuracy: Locations aren’t always correct on real estate listings. Oftentimes, lots don’t have actual addresses and the map where it shows might default to the heart of the city that you are looking in. Our lot listing for the land we purchased showed in a completely different area. The pictures on our listing weren’t even all pictures of the actual land we were purchasing. All of the pictures of flat, cleared out land was not our lot. This was the listing.

- Check for Internet Access: You might not have internet access in certain areas (shocking i know) , but internet providers don’t put in expensive nodes if they don’t think they will get their money back with people purchasing internet from them. Fortunately, our land is close enough to a node, but if we placed our house on a different part of our land, we would not have internet access. There were countless pieces of land that we might have had put an offer on, but because the possibility of getting internet was slim or would insanely expensive, we passed on it. If internet is important to you please make sure you check for this.

- Subdivided Land: The lot you are looking at could have been recently subdivided. All that means is that it was a larger piece of land split up into different parcels for an easier sell. This was the case for our particular lot, which leads to my next point.

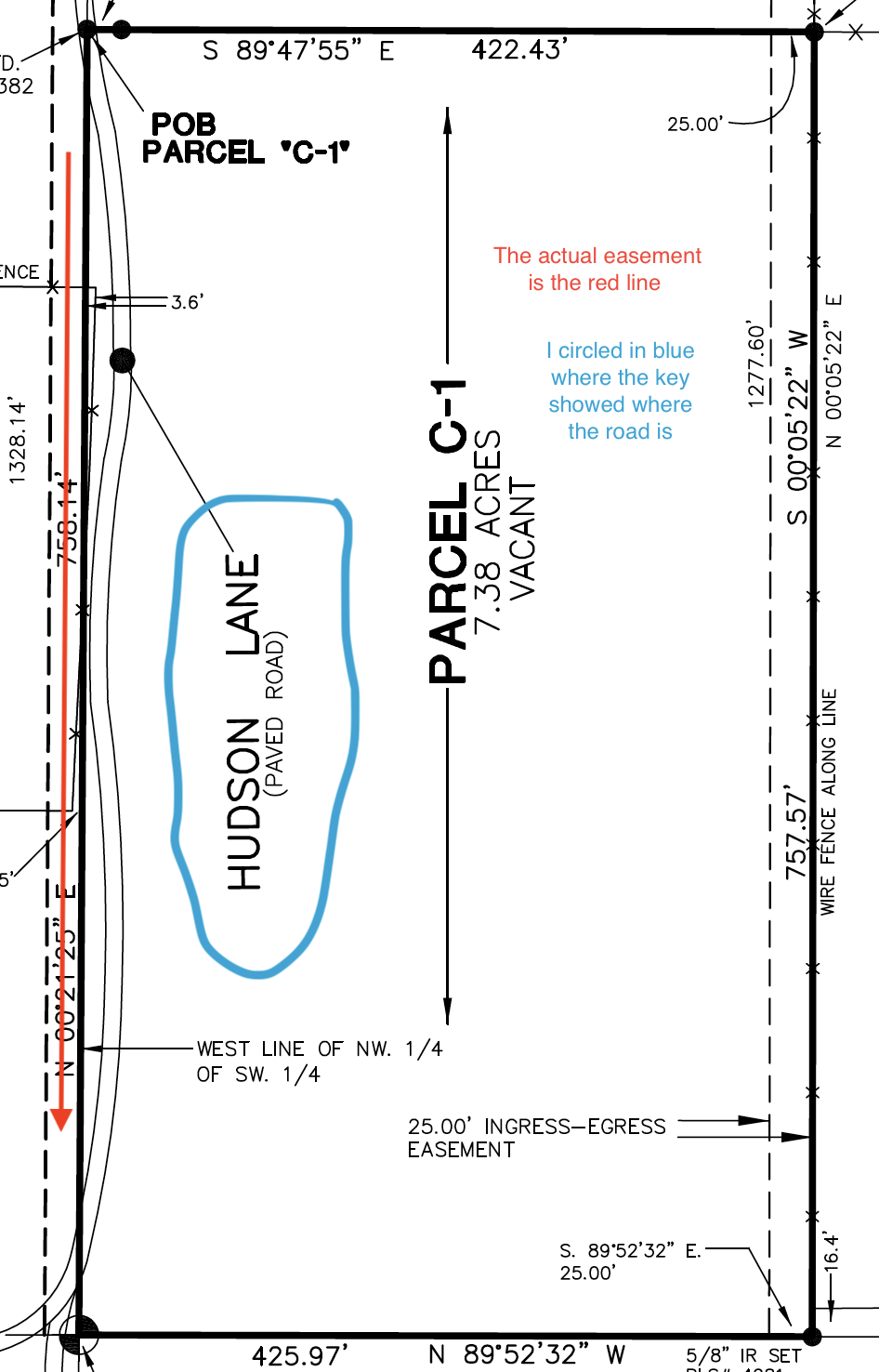

- Check Easements: Before all of this, I didn’t even know what an easement was. An easement gives others a right to use your property as a right of way to their property. Our property technically only had one easement on our survey. However, the main road into the.”neighborhood” was not in the correct spot and runs through our property. The actual easement (which is where the road is supposed to be) was blocked by a fence in the property across from ours. Technically we were losing about a half acre of personal property due to the road being in the wrong spot.

- Get legal Advice: We consulted with our real estate lawyer to figure out what our liability would be if someone for hurt driving on the road. That particular road services about 6 homes. Homeowners insurance covers some liability and we could choose to get more liability coverage just in case. For the most part, a judge would more than likely throw out such a lawsuit. Our lawyer offered to draw up an agreement where all of the neighbors would sign to waiver our liability. If they didn’t sign, we could technically block the road and force them to drive on where the actual easement is. We haven’t gone that route yet and we are still weighing our options on everything.

- Land purchase negotiation: We knocked off an additional $5000 from our initial offer due to the road being in the wrong spot. We got permission to move the fence that was blocking the actual easement. (the owners of the each parcel were related). Not mention, we offered $125,000 on a $150,000 listing price by comparing nearby sales per acre and the fact that it had 600 dead orange trees on it. So our final price was $120,000. A shout out to our realtors The Toolbox Sisters.

- Pay Cash: If possible, pay cash for land. It’s a great negotiation tool for purchasing power and you can use whatever you paid for the land as a down payment for your construction loan.

- Legal Road Agreement: For our particular bank, since both easements leading to our property are privately owned, we had to have a road agreement with owners that determined who was responsible for maintenance. We had to have an agreement with everyone else that owned the road heading in toward our property. We picked the easement that had the least amount of neighbors to have to get to sign. The bank needs to know that the road will be maintained so that in case of a fire, or other type of emergency, public service vehicles can get to the house for insurance purposes. We had to go to our lawyer in order write up the agreement and get our neighbor to agree and sign. We also had to make sure it was on pubic record in order for the bank to issue us our loan. Scharber Law made this interaction easy and stress free.

- Wells and subdivided land: Our neighbor to the north of us actually contacted us because at one point, all of the parcels were one big parcel that had a well that irrigated all of the trees. The well was on her property and she said we have legal rights to access it (it currently wasn’t working/ needed serviced). We had no idea and assumed that we didn’t have access to it, but we ended up signing a document waiving our rights since we are drilling our own well.

- Well and Septic expense: You will more than likely need to budget for well and septic. Chances are land you purchase won’t have access to city water, but it might. If it does, you are paying for that in your purchase price. Add about $15,000 to your construction budget for that.

- Check the Zoning: We were considering two different properties , but because of how it was zoned we chose on over the other. We wanted the possibility to subdivide in the future if we wanted to sell an acre or two to a relative. The property we decided to not purchase was zoned Agriculture Commercial and would need to be rezoned first and subdivided and we didn’t want to have to go through that (although i don’t know how difficult it would have been).

- To move the Road or Not: That is the question we have now. We have to actually dig up part of the road in order to get electrical underground. The actual easement is also blocked by some trees that need to be tore down. Then, there is the cost of paving and making sure all of the neighbors are okay with the road being moved to the correct place. One neighbor will actually lose a little part of his (very large) front yard and isn’t too happy about it. We had even discussed the possibility of the road moving with him before purchasing, but is not happy about it now that we’ve purchased.

This was the location that showed in the real estate listing, which is why initially i never looked at it. We had to google the street name in order to actually find it.